光伏,是推動能源結構調整和產業綠色轉型的重要產品。當前,美國一方面高筑保護主義院墻,采取多重貿易限制手段,層層加碼設置光伏關稅壁壘;另一方面通過《通脹削減法》和《基礎設施投資與就業法》等法案,實施排他性、歧視性的產業政策,向其本土光伏產業提供大規模涉嫌違反多邊規則的補貼,嚴重扭曲全球光伏產業鏈供應鏈的市場化運行,破壞全球共同應對氣候變化等領域的國際合作。

一、美國《通脹削減法》為光伏制造和裝機提供巨額補貼

美國于2022年出臺的《通脹削減法》,提供高達3690億美元補貼,以扶持包括本土光伏產品在內的清潔能源產業投資和生產,以圖重構光伏產業鏈供應鏈。

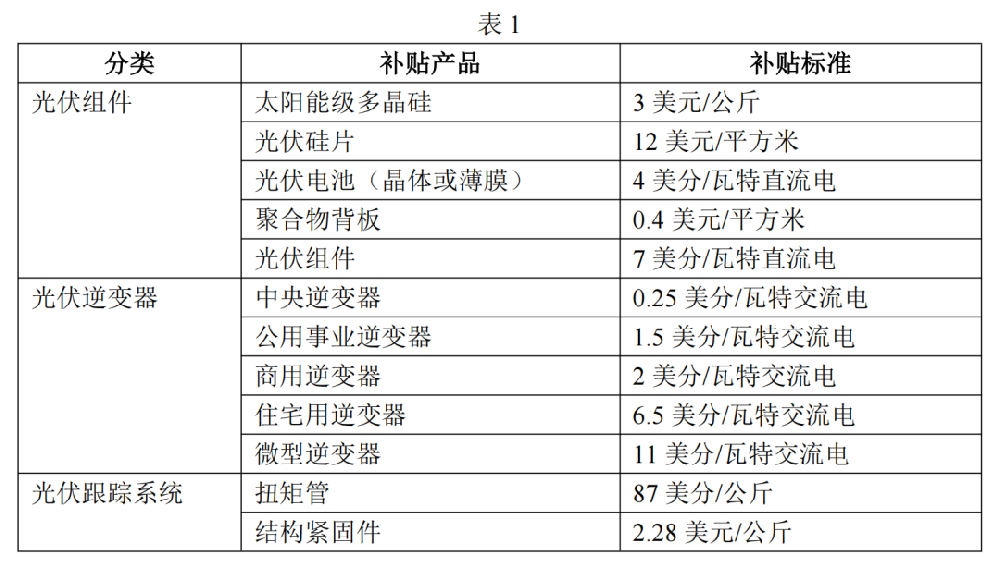

(一)在光伏產品制造方面,美國聯邦政府根據投資額或者產出產品的規格,向光伏企業提供稅收抵免補貼。投資稅收抵免總額度高達100億美元,涵蓋光伏等清潔能源制造業項目,抵免比例最高可達項目投資額的30%。生產稅收抵免涵蓋光伏原材料、電池片、組件和相關配套產品,具體抵免標準見表1:

得益于美國政府對光伏制造業的巨額補貼,本土企業甚至能在一邊營收虧損的情況下,一邊不斷擴大美國本土制造業務。以美國第一太陽能公司(First Solar)為例,根據其2023年財報,該公司全年實現8.31億美元凈利潤,其中約有6.597億美元來自補貼(Government grants receivable),占比達到了79.39%,而2021年和2022年都無該項收益。2024年一季度,該公司財報實現凈利潤2.367億美元,其中政府補貼2.82億美元,即扣除政府補貼后,第一太陽能公司2024年第一季度凈虧損4527萬美元。這一扭虧為盈的巨大變化完全得益于美國政府對光伏產業的巨額補貼和稅收抵免支持。與此同時,該公司宣布計劃擴建其在俄亥俄州的光伏組件工廠,并在阿拉巴馬州和路易斯安那州各新建一座光伏組件廠,總投資額高達 24 億美元,計劃將現有產能擴大4倍以上。

除組件企業外,美國光伏原材料和配件企業也獲得了大量補貼。根據美國能源部近期發布的信息,美國國稅局已為在35個州開發的100多個項目分配了約40億美元的稅收抵免。其中已披露的光伏項目包括:Highland Materials公司獲得2.556億美元,用于在田納西州生產太陽能級多晶硅;Solar Cycle公司獲得6400萬美元,用于在佐治亞州生產太陽能玻璃。

此外,為配合《通脹削減法》生產稅收抵免政策的實施,美國能源部貸款項目辦公室向本土晶體硅光伏制造商Qcells提供14.5億美元貸款擔保,支持其在佐治亞州卡特斯維爾的光伏產業鏈項目。該項目建成后將生產硅錠、硅片、電池片和成品光伏電池組件,并將成為美國有史以來最大的硅錠和硅片廠,補充美國本土光伏產業鏈中的關鍵缺口。

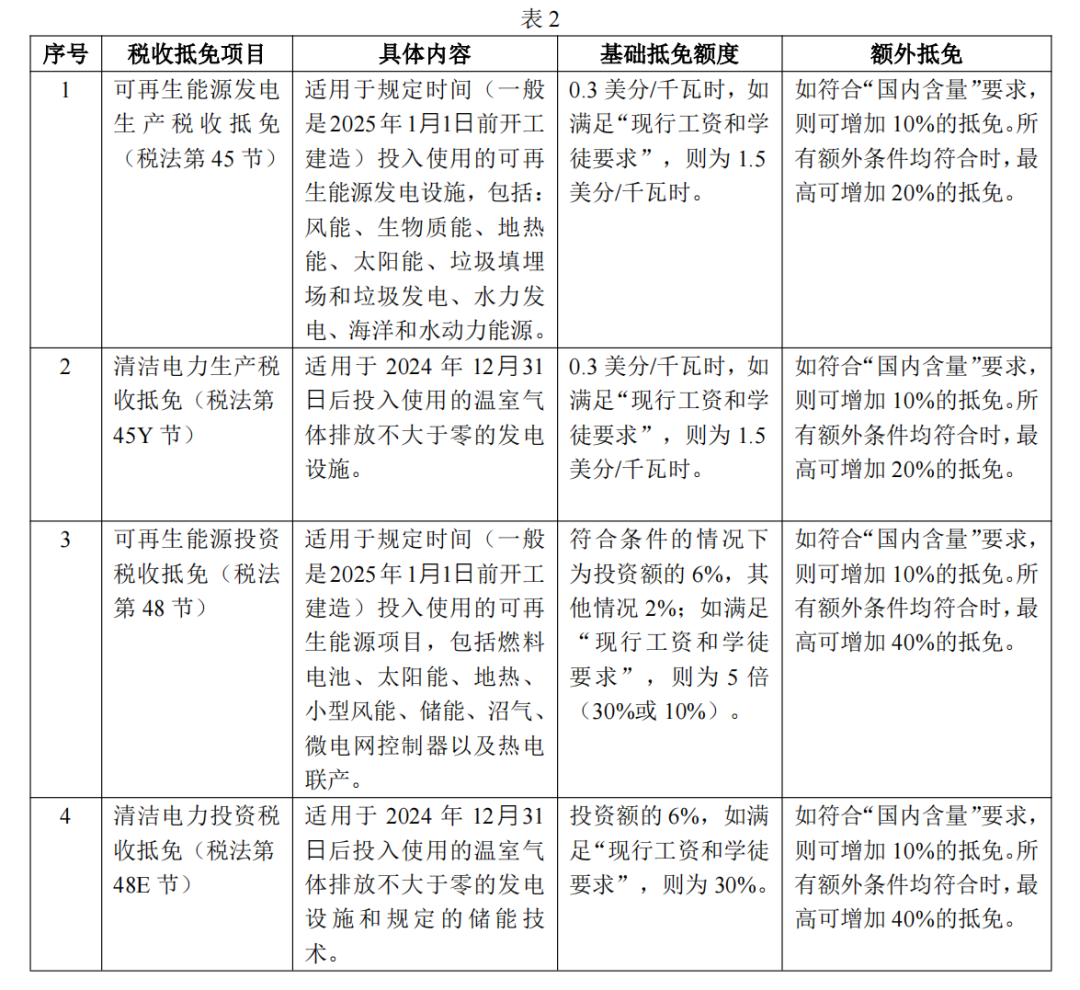

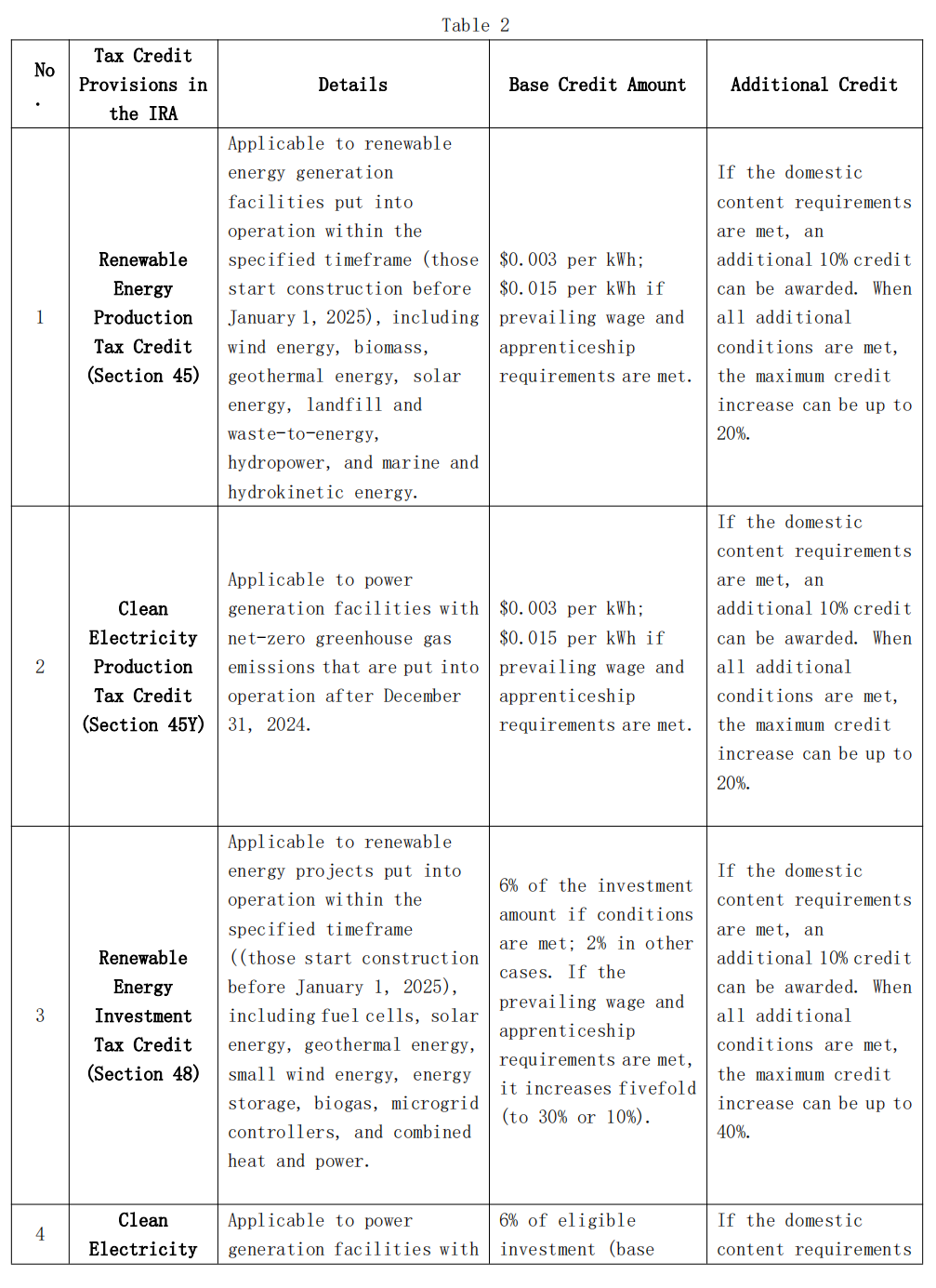

(二)在光伏發電項目方面,美國《通脹削減法》對本土光伏發電項目主要提供四類稅收抵免政策,具體見表2。值得注意的是,這四類補貼政策中,如果項目滿足“國內含量”要求,均將獲得額外的稅收抵免額度。“國內含量”是指項目使用了一定比例的在美國開采、生產或制造的鋼、鐵或制成品,涉嫌違反世貿組織規則下的“國民待遇”義務。

(三)戶用光伏應用方面,2023年6月28日,拜登政府宣布了“人人享有太陽能”(Solar for All)計劃,這是《通脹削減法》中總計270億美元的“溫室氣體減排基金”的重要組成部分。該計劃旨在提供70億美元撥款,用于補貼住宅屋頂和社區分布式太陽能項目,以降低安裝和使用太陽能的成本。

二、美國對光伏技術研發提供大量撥款補貼

美國能源部太陽能技術辦公室(Solar Energy Technologies Office,SETO)每年設立資助計劃,為光伏研發和示范項目提供直接資助,資金來源為能源部和《基礎設施投資與就業法》。2024年5月16日,美國能源部宣布投資7100萬美元,其中包括來自《基礎設施投資與就業法》的1600萬美元,用于資助“晶硅光伏制造和兩用光伏技術孵化器資助計劃”(2700萬美元)和“推進美國薄膜太陽能光伏技術資助計劃”(4400萬美元),解決國內光伏供應鏈制造能力的差距。

(一)光伏研發和示范項目資助

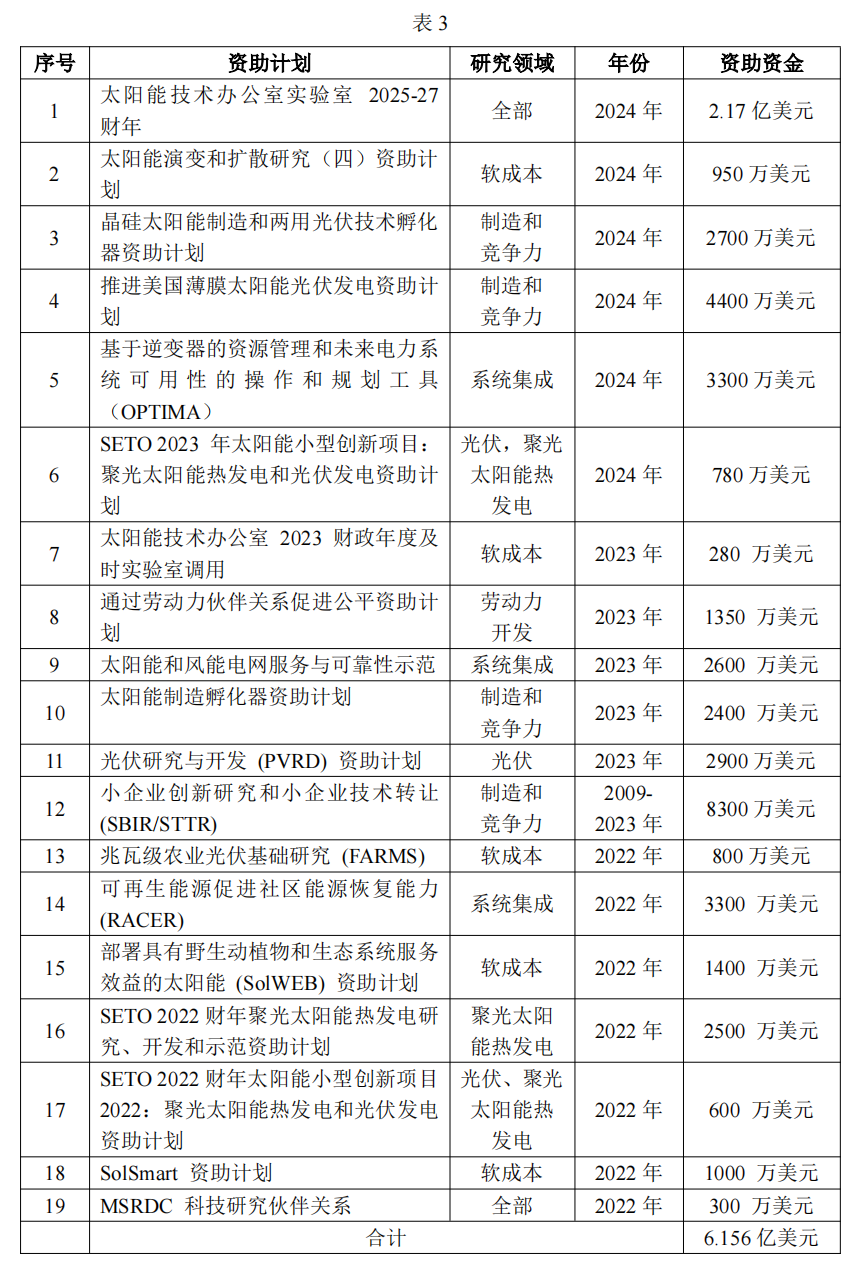

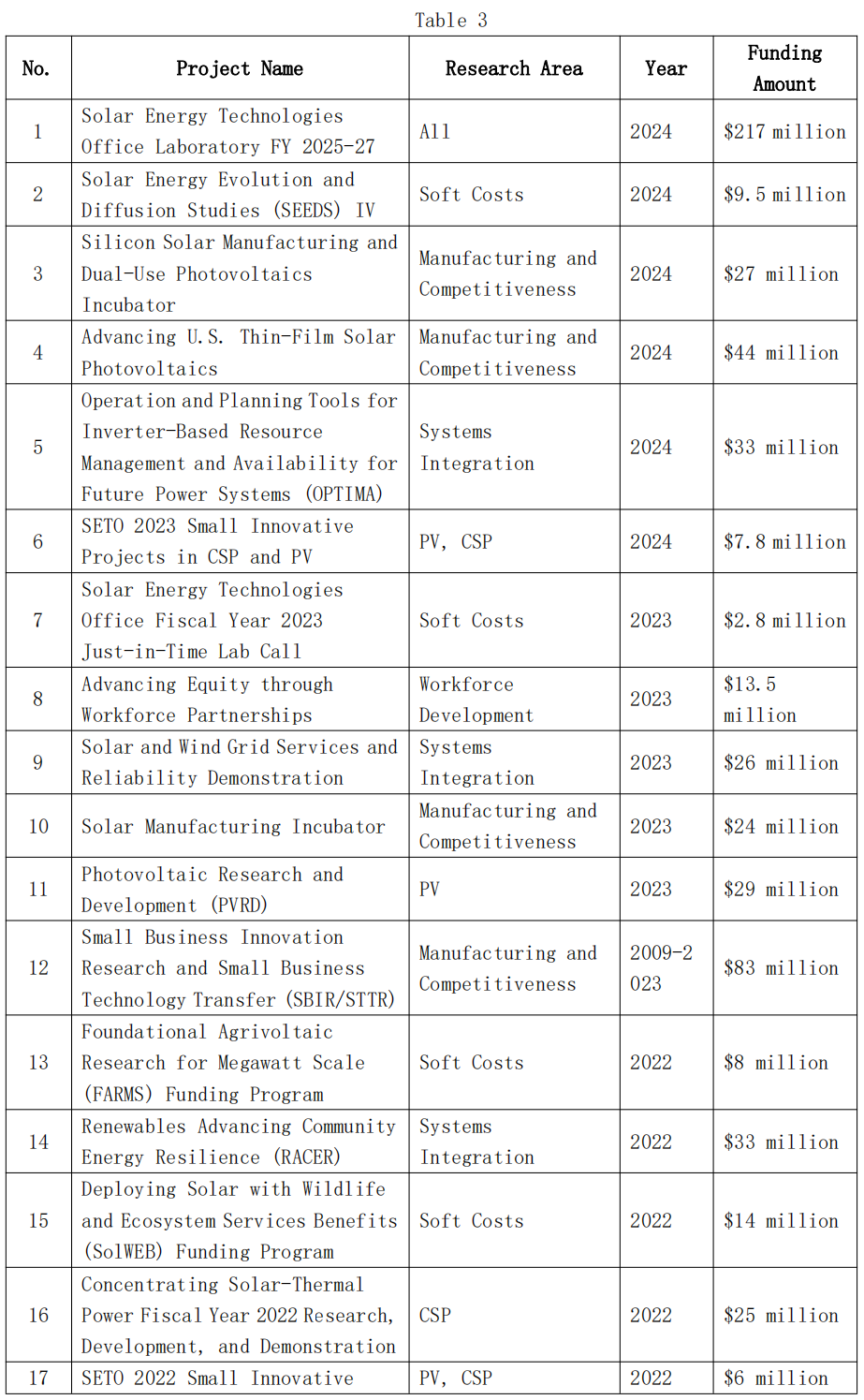

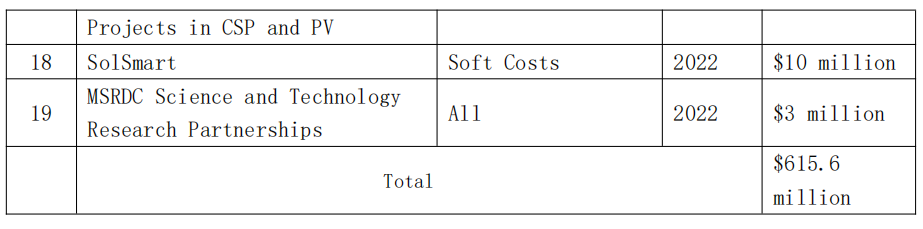

根據美國能源部太陽能技術辦公室發布的信息,2022年至今,該機構在執行的光伏研發和示范項目資助計劃共有19項,共計6.156億美元。具體見表3:

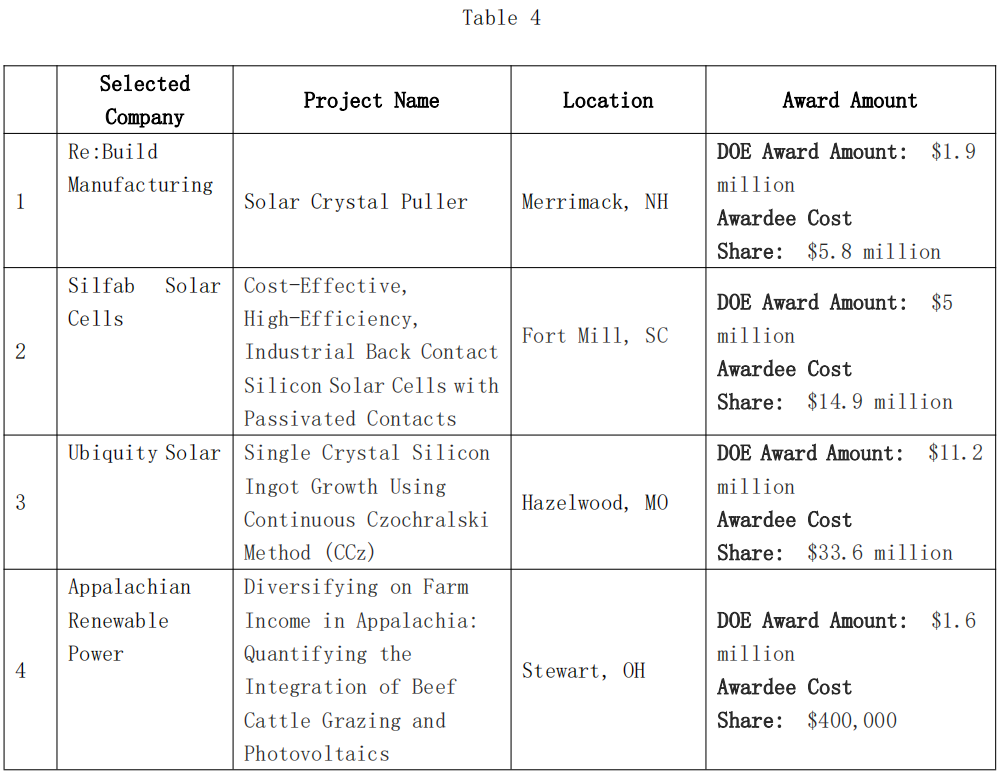

(二)晶硅光伏制造和兩用光伏技術孵化器資助計劃

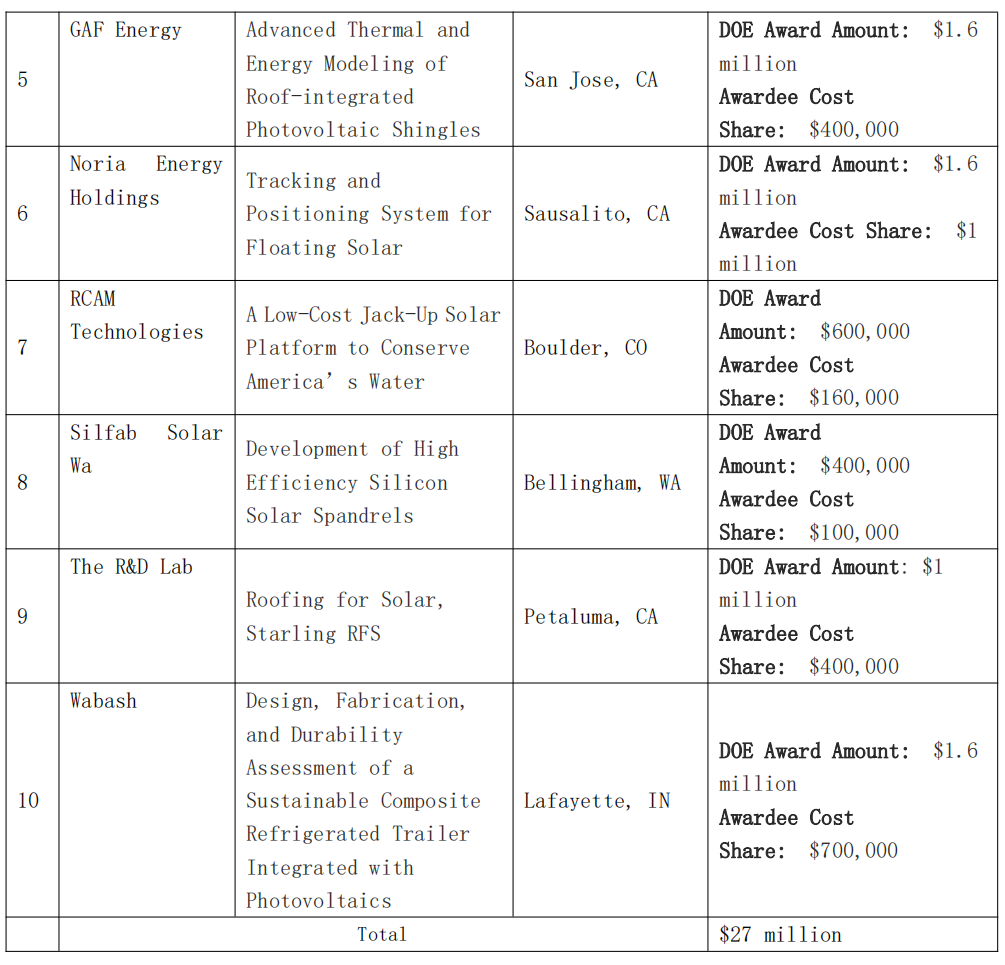

晶硅光伏制造和兩用光伏技術孵化器資助計劃(表3第3項)額度為2700萬美元,為開發下一代太陽能技術的項目提供支持。2024年5月16日,美國能源部太陽能技術辦公室公布了10個入選項目。具體見表4:

(三)推進美國薄膜太陽能光伏發電資助計劃

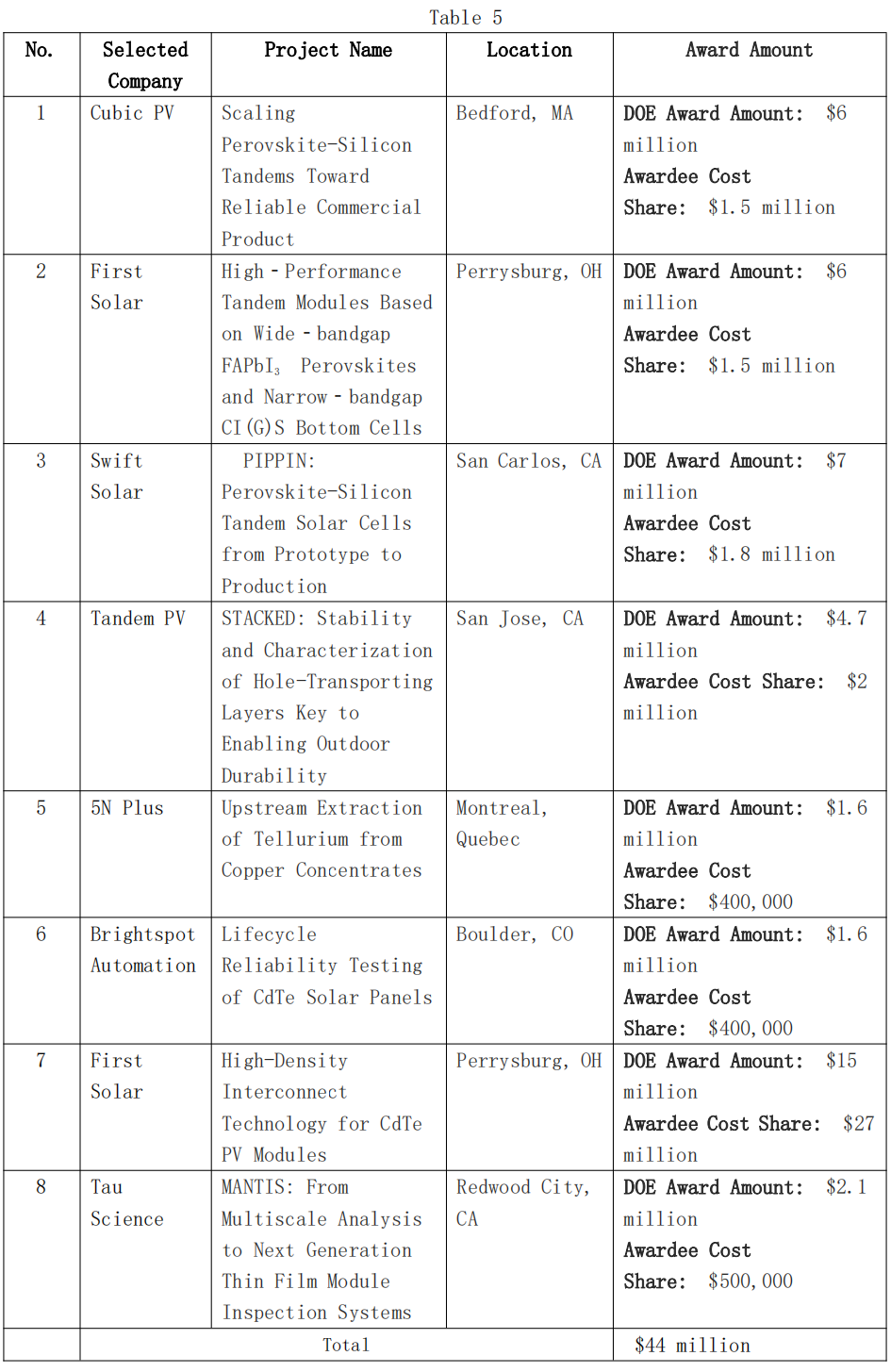

推進美國薄膜太陽能光伏技術資助計劃(表3第4項),為本土薄膜光伏技術的研究、開發和示范項目撥款4400萬美元。美國能源部太陽能技術辦公室于2024年5月16日公布了資助結果。具體見表5:

三、美國對光伏行業的地方補貼措施種類多、數量眾

美國各州和地方層面也出臺了眾多補貼措施以支持光伏產業的發展。DSIRE數據庫收錄了美國各州層面的針對光伏產業及其技術發展的財政激勵措施共計419項,包括:返利計劃(87項)、優惠貸款(76項)、財產稅優惠(72項)、清潔能源融資計劃(35項)、銷售稅優惠(34項)和贈款計劃(29項)等。各州相比,最多的科羅拉多州有26項財政激勵政策,德克薩斯州為25項,加利福尼亞州為18項。

以科羅拉多州為例,科羅拉多州阿斯彭市的返利計劃,為商業和住宅光伏發電提供激勵,標準為前6千瓦補貼200美元/千瓦,此后按100美元/千瓦補貼,上限為3400美元或25千瓦。科羅拉多州能源智能能效返利計劃還對太陽能光伏系統提供項目成本的25%(最高2500美元)的補貼。

在優惠融資方面,科羅拉多州制定了一項全州范圍的PACE(Property Assessed Clean Energy,即清潔能源分期)計劃,允許商業業主為節能和可再生能源項目的前期費用,申請100%的融資額,業主可有最長20年的融資期限。科羅拉多州清潔能源基金的住宅能源升級貸款計劃為住宅安裝太陽能光伏設施提供無首付低利率最高7.5萬美元最長20年的貸款。

在財產稅優惠政策方面,科羅拉多州自2006年7月1日起,免除了用于可再生能源發電的所有組件銷售、儲存和使用的州銷售和使用稅。對于住宅而言,由住宅業主擁有并生產供住宅財產使用的能源的可再生能源個人財產免征科羅拉多州財產稅。

在直接贈款方面,科羅拉多州的博爾德市通過太陽能補助計劃提供根據系統容量每瓦1美元的資助,最高上限為8000美元或總成本的50%。

四、美國光伏補貼政策充分體現“雙重標準”,并將導致“產能過剩”

近期,美國頻繁指責中國新能源行業存在大量補貼,同時,自己卻通過實施排他性、歧視性的補貼政策,大肆擴張自身產能,是典型的“雙重標準”行徑,并且將導致美國光伏產業出現“產能過剩”,沖擊全球光伏行業的健康發展。《通脹削減法》實施后,美國計劃建設的光伏產能大幅增長。根據美國太陽能產業協會(SEIA)統計,截至2023年10月,美國本土有25條組件生產線和2家多晶硅供應商、9家逆變器供應商、2家光伏玻璃供應商、1家背板供應商;共有運營中組件產能13GW,多晶硅4萬噸;正在建設中的有19.4GW的組件產能和各3.3GW的電池、硅片、鑄錠產能;已宣布計劃設廠的另有45GW的電池產能、80GW的組件產能、14GW的鑄錠產能和27GW的硅片產能。據美國咨詢公司伍德麥肯茲統計,根據目前已公布的規劃,2026年美國光伏組件產能將超過120GW,是屆時本土光伏裝機需求的3倍。

以《通脹削減法》為代表的美國光伏補貼政策,罔顧多邊經貿規則,將使用美國國內商品而非進口商品作為補貼獲得條件,是赤裸裸的違背“國民待遇”義務的歧視性政策。中國已于2024年3月26日將美國《通脹削減法》中的相關補貼政策訴至世界貿易組織。與美國磋商無果后,中國于7月15日申請世貿組織就審理該案成立專家組。無論如何包裝美化,都無法改變美國光伏補貼政策的歧視性、違規性和保護主義本質。

Huge Illegal Subsidies on U.S. Solar Industries Distort Global PV Market

Solar photovoltaic (PV) products are crucial for the adjustment of energy structure and the green transformation of industries. Currently, the United States has built high walls of protectionism by imposing multiple trade restrictions and continuously increasing tariff barriers on imported PV products. On the other hand, it implemented exclusive and discriminatory industrial policies through legislation such as the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), and subsidized its own PV industry in a large scale which violated the multilateral trade rules and severely distorted the market operations of the global supply chain of PV industry and impeded international cooperation in areas such as climate change.

I.The U.S. Inflation Reduction Act provides unprecedented subsidies for PV manufacturing and installation

The Inflation Reduction Act, introduced in 2022, offers subsidies of an unprecedented $369 billion to support investments and production in the clean energy sector, including domestic photovoltaic products, aiming to reconstruct the PV industry chain.

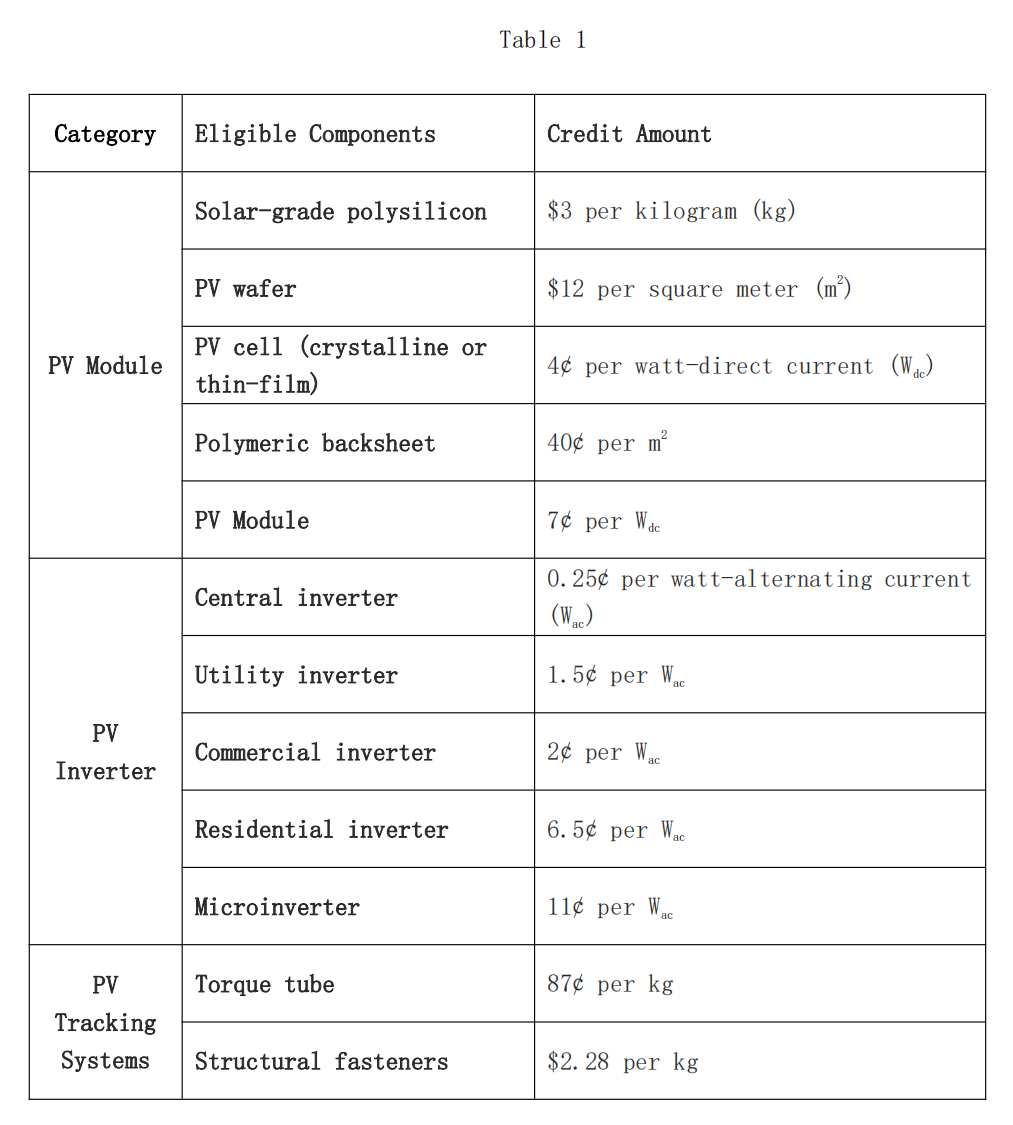

i.In terms of PV manufacturing, the U.S. federal government provides tax credits to PV companies based on their investment amount or product specifications, which amount to $10 billion, covering projects in the clean energy manufacturing sector, including PV, with credit rates reaching up to 30% of the investment. Photovoltaic raw materials, cells, modules, and supporting products are all eligible for tax credits, with specific standards listed in Table 1.

Benefiting from substantial government subsidies, American PV companies are able to continuously expand their manufacturing in the country while facing revenue losses. Take First Solar as an example. According to its 2023 financial report, the company achieved a net profit of $830.777 million, with approximately $659.745 million labeled as government grants receivable, accounting for 79.39% of its profit. This part of income did not exist in 2021 and 2022. In the first quarter of 2024, the company reported a net profit of $236.616 million, with government grant amounting to $281.889 million. Without the subsidies, First Solar would have incurred a net loss of $45.27 million during that period. This significant turnaround was entirely due to the huge amount of government subsidies and tax credit. Meanwhile, the company announced plans to expand its PV module factory in Ohio and to build new factories in Alabama and Louisiana with $2.4 billion of investment, aiming to quadruple its current capacity.

In addition to module manufacturers, companies of raw material and accessories in the industry have also received plenty of subsidies. According to the U.S. Department of Energy, the Internal Revenue Service has allocated approximately $4 billion in tax credits for more than 100 projects developed in 35 states. Among the voluntarily disclosed PV projects were Highland Materials, which received $255.6 million for producing solar-grade polysilicon in Tennessee, and SolarCycle, which received $64 million for producing solar glass in Georgia.

Additionally, to support the implementation of the production tax credit policy under the IRA, the U.S. Department of Energy"s Loan Programs Office has provided a $1.45 billion loan guarantee to domestic crystalline silicon photovoltaic manufacturer Qcells, which supports its PV industry chain project in Cartersville, Georgia. Once completed, the project will produce silicon ingots, wafers, cells, and finished PV modules, making it the largest silicon ingot and wafer plant in the country, addressing a critical gap in its domestic PV supply chain.

ii. For PV power generation, the Inflation Reduction Act provides four main types of tax credits for domestic projects, as illustrated in Table 2. Notably, for each of these four subsidy policies, projects that meet the requirements in domestic content will receive an additional tax credit. Domestic content refers to using a certain proportion of steel, iron, or manufactured goods, mined, produced, or manufactured in the United States, which may violate the WTO’s national treatment principle.

iii. For residential PV applications, on June 28, 2023, the Biden administration announced the Solar for All initiative, which is a key component of the $27 billion Greenhouse Gas Reduction Fund under the IRA. This initiative provides $7 billion for residential rooftop and community distributed solar projects, reducing the cost of PV installation and usage.

II.The U.S. provides substantial grants and subsidies for the research and development of photovoltaic technologies

The U.S. Department of Energy"s Solar Energy Technologies Office (SETO) establishes annual funding programs to provide direct support for PV research and development, and demonstration projects, funded by the Department of Energy and the IIJA. On May 16, 2024, the Department of Energy announced a $71 million investment, including $16 million from the IIJA, to fund the The Silicon Solar Manufacturing and Dual-Use Photovoltaics Incubator Program ($27 million) and the Advancing U.S. Thin-Film Solar Photovoltaics Funding Program ($44 million), aiming to close gaps in PV supply chain manufacturing capabilities.

i.Funding for PV R&D and Demonstration Projects

According to SETO of the U.S. Department of Energy, since 2022, 19 PV research and development, and demonstration project funding programs have been implemented, totaling $615.6 million, with details listed in Table 3.

ii.Silicon Solar Manufacturing and Dual-Use Photovoltaics Incubator

The Silicon Solar Manufacturing and Dual-Use Photovoltaics Incubator Program (No. 3 in Table 3) deploys $27 million to support the development of the next-generation solar technologies. On May 16, 2024, SETO announced 10 selected projects as listed in Table 4:

iii. Advancing the U.S. Thin-Film Solar Photovoltaics Funding Program

The Advancing U.S. Thin-Film Solar Photovoltaics Funding Program (No. 4 in Table 3) has allocated $44 million for local research, development, and demonstration projects on two major thin-film photovoltaic technologies. The U.S. Department of Energy Solar Energy Technologies Office announced the funding results on May 16, 2024. See Table 5 for the details.

III.Numerous local subsidies for the U.S solar industry

State and local governments in the U.S. have also launched numerous subsidies for the solar industry. The DSIRE database records 419 state-level fiscal incentives for the industry and its technological advancement, including rebate programs (87), loan programs (76), property tax incentives (72), PACE financing programs (35), sales tax incentives (34), and grant programs (29). Among all, Colorado enjoys the most financial incentive policies with 26, followed by Texas with 25, and California with 18.

In Colorado, the City of Aspen Rebate Program offers incentives for commercial and residential solar PV installations. The rebate is $200/kW for the first 6 kilowatts and $100/kW thereafter, with a maximum of $3,400 or 25 kilowatts. The Roaring Fork Valley Energy Smart Colorado Energy Efficiency Rebate Program provides a rebate of 25% of the project cost for solar PV systems, up to $2,500.

In terms of favorable financing, Colorado has implemented a statewide Property Assessed Clean Energy (PACE) program that allows commercial property owners to finance 100% of the upfront costs for energy efficiency and renewable energy projects, with financing terms up to 20 years. The Colorado Clean Energy Fund"s Residential Energy Upgrade (RENU) Loan Program offers no-money-down, low-interest loans up to $75,000 for up to 20 years for residential solar PV installations.

Regarding property tax incentives, since July 1, 2006, Colorado has exempted state sales and use tax for all components used to produce AC electricity from renewable energy. For residential properties, renewable energy personal property owned and used by residential property owners to produce energy for residential use is exempt from Colorado property tax.

As for direct grants, the city Boulder in Colorado provides funding through the Solar Grant Program, which offers $1/W, with a maximum of $8,000 or 50% of the total cost.

IV.The solar subsidy policies in the U.S. reflects double standards and will lead to overcapacity

In recent years, the U.S. has frequently accused China"s new energy sector of excessive subsidies. Simultaneously, it is aggressively expanding its solar capacity through exclusive and discriminatory subsidy policies, demonstrating typical double standards. These actions will lead to overcapacity in the U.S. and impact the healthy industry development worldwide. After the implementation of the Inflation Reduction Act, planned solar capacity in America has significantly increased. According to the Solar Energy Industries Association (SEIA), as of October 2023, the U.S. has 25 module production lines, 2 polysilicon suppliers, 9 inverter suppliers, 2 photovoltaic glass suppliers, and 1 backsheet supplier. The operating capacity includes 13GW of modules and 40,000 tons of polysilicon. Under construction are 19.4GW of module capacity and 3.3GW each of cell, wafer, and ingot capacity. Additionally, there are announced plans for 45GW of cell capacity, 80GW of module capacity, 14GW of ingot capacity, and 27GW of wafer capacity. According to Wood Mackenzie, based on current plans, U.S. solar module capacity will exceed 120GW by 2026, three times of the domestic demand for solar installations at that time.

The U.S. solar subsidy policies, represented by the Inflation Reduction Act, disregard multilateral trade rules, making the use of domestic goods rather than imported goods a condition for obtaining subsidies. These discriminatory policies blatantly violate the U.S.’s national treatment obligation under the WTO rules. On March 26, 2024, China filed a complaint with the WTO regarding the relevant policies in the U.S. Inflation Reduction Act. After unsuccessful consultations with the U.S., China requested the WTO to establish a panel to review the case on July 15. Regardless of its camouflage, the subsidies demonstrate the clear essence of violation of rules,discrimination and protectionism of the U.S.solar subsidy policy.